Trends in Car Sharing 2026

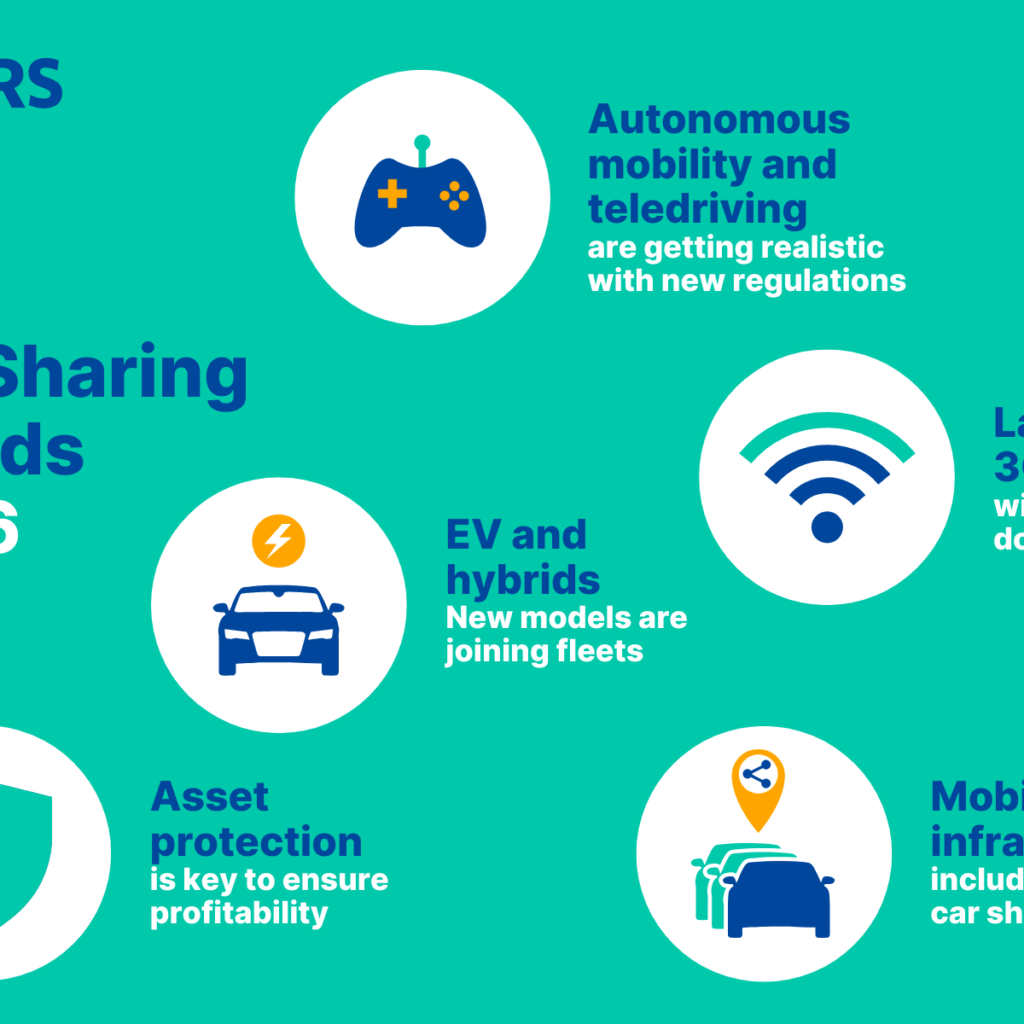

Autonomous and tele-driven, the shutdown of 2G and 3G, new EVs, asset protection and integration into public transport and comprehensive mobility concepts – those are five trends that will shape the car sharing industry in 2026.

Throughout the ending year 2025 the car sharing industry was mainly marked by a strategic shift from expansion to profitability. In terms of size, the European station‑based and free‑floating fleets have reached roughly 129,000 vehicles with about 8% year‑over‑year growth over the last year, confirming that car sharing remains in a growth phase even as operators consolidate footprints and exit weaker markets. “Rising vehicle and maintenance costs, together with tight city regulations and zero‑emission targets, are making car sharing more central in urban mobility policy”, says Bharath Devanathan, Chief Business Officer at Invers. “At the same time, we hear from customers and industry experts that those developments also push operators to scrutinize unit economics and optimize operations to improve margins through new technologies.” Overall, the following five key trends for the coming year have emerged from discussions with customers and experts:

1. New regulation pushes autonomous mobility and teledriving

The concept of teledriving has been trialled in the EU for some time. New legislation is now paving the way for its expansion. In Germany, a legal framework for teledriving has come into effect on 1 December 2025, initially limited to a period of five years. Vay, a Hamburg-based start-up, has already been testing driverless rental cars since 2024 in Las Vegas, where remote-control driving is permitted. Customers can order a rental car via an app, and the vehicle arrives driverless right outside their front door. After the journey, the remote driver takes over again. Green Mobility, a leading car sharing operator in Copenhagen, has been showcasing one of Europe’s first autonomous cars in November 2025 and is exploring the potential of shared autonomous cars.

2. Most countries shut down 2G and 3G soon

Many countries have already closed their 2G and 3G networks. Switzerland is expected to follow suit in 2026, by which time both technologies will be obsolete. France is planning to shut down its 3G networks by 2026. Several countries on all continents have already set dates for the ‘sunset’ of 2G and 3G in order to make room for higher-speed cellular networks such as 4G and 5G. This also means that car-sharing technology needs to adapt to the new requirements. The best option to solve this issue is the standard Long-Term Evolution for Machines (LTE-M). LTE-M is a low-power wide-area cellular standard, designed specifically for Internet of Things and machine-to-machine communications. It offers wide-area coverage, good mobility support, and multi-year battery life for devices that need moderate data rates, such as trackers, sensors, and smart meters. This standard will be available for many years to come and is suitable for the requirements of the car-sharing sector.

3. New EVs and hybrid models are joining fleets

Electric and hybrid vehicles already comprise a significant and growing percentage of many European car-sharing fleets. Some countries and operators report that around one-fifth of their shared cars are fully electric. Adoption is strongest in markets with supportive policies and dense urban charging networks. This can be seen in countries such as Germany, Italy, Spain, and the UK, where electric car sharing is explicitly promoted as part of climate and mobility strategies. In 2025, the Invers team analyzed more than 90 EVs and hybrids, including new models such as the Toyota Yaris Cross Hybrid and the Genesis GV60. Recently, models such as the 5 E-Tech Electric from Renault, the T 10 from Togg, the EV3 from Kia, the C-HR Hybrid from Toyota, and the Sealion 7 from BYD have been analyzed for car-sharing operations. There is also a trend towards incorporating more hybrids into fleets, which offer the benefits of EVs in inner-city operation without the disadvantage of searching for charging stations. Additionally, car-sharing companies continue to test EV models from China and new manufacturers, such as Togg from Turkey, to determine if they offer good value for car sharing. Furthermore, manufacturers use car-sharing fleets to introduce models to a broader base of everyday users.

4. Asset protection is key to ensure profitability

As carsharing fleets and usage are growing, so is the risk of damage. Internal report from carsharing operators show, that while reckless driving behaviour accounts for only 1 to 2 percent of vehicle rentals, it is responsible for more than 40 percent of all damage costs. Damage and associated costs, as well as rising insurance prices, are among the main challenges currently facing car sharing operators. Therefore, protecting and maintaining the quality of vehicles is a key factor in ensuring operator profitability. Focusing on asset protection through efficient strategies and systems is becoming an increasingly useful and inevitable requirement for successful businesses. Asset protection also increases vehicle uptime, which has a direct impact on profitability.

5. Car sharing as part of mobility infrastructure

Car sharing is no longer seen as a niche mobility mode mainly used in urban areas but is increasingly integrated in city’s overall mobility infrastructure. Politicians and administrators are actively incorporating car sharing into urban development plans by creating usage areas and forming partnerships. Flinkster, for example, Deutsche Bahn’s car sharing service, combines local and long-distance public transport with car sharing. The concept of condo car sharing, which is private car sharing for neighborhoods, is being introduced by car sharing providers like Carré Mobility. Recent studies have shown that one car sharing vehicle can replace up to 23 private vehicles. The integration of car sharing into the mobility infrastructure is leading to a change in mobility behaviour and fewer cars in cities, creating more usable and green spaces in urban areas.